What is a Short Sale?

The concept behind the short sale is simple: To convince the seller’s mortgage lender(s) to accept a payoff for less than the balance due on the loan.

Once the homeowner decides to allow the short sale, there is important paperwork needs to be filled and signed:

- “Authorization to Release” – form that gives Borgia Law permission to contact the lenders and the foreclosing attorneys;

- “Listing Agreement” – signed and dated by both the sellers and the agent;

- “Sales Contract” – some lenders allow for the short sale to begin without a buyer in place, others require a buyer prior to ginning the short sale process;

- “Financial Statement” – Provided by seller to lender to give a complete picture of the seller’s financial situation; and

- “Hardship letter” – to explain Provided by seller to lender to give seller’s explanation of hardship.

Do the homeowners still owe the bank money after a real estate short sale?

That is a good question. The goal of a successfully negotiated short sale, is to get the bank to accept the agreed upon price as payment in full and for the bank to waive its right to pursue a deficiency judgment.

However, this is not always possible and some homeowners may still owe the difference between the mortgage balance and the discounted short sale payoff amount. The bank may seek a monetary “deficiency judgment” through court action. If granted, this judgment will affect the homeowner and his credit report just as any other judgment.

If the bank does pursue a deficiency judgment, the homeowner may have to repay the deficiency judgment or file bankruptcy at a later date to remove the judgment.

What is a deficiency judgment? The bank may seek a judgment, through the court, for the difference between the actual amount received and the total amount owed by the seller to the lender. For example, if the bank is owed $100,000 and agrees to accept $65,000 on a short sale, the judgment can be obtained and recorded against the homeowners for $35,000.

Will the homeowner still owe the IRS money after a real estate short sale? In the event the bank accepts “payment in full without pursuit of any deficiency judgment”, the amount of the debt that has been forgiven is generally considered by the IRS to be “taxable income”. In the event of debt forgiveness, the bank will issue a 1099-C.

What is a 1099-C? The form 1099-C, Cancellation of Debt, is given to the homeowner and reported to the IRS thereby allowing the forgiven portion of the debt to be treated as income that the homeowner received. For example, if the bank is owed $100,000 and agrees to accept $65,000 on a short sale, the homeowner actually received “income” in the amount of $35,000 (the short sale amount) and can receive a 1099-C for that amount.

However, if you do receive a 1099-C from the bank, “The Mortgage Debt Relief Act of 2007” generally allows taxpayers to exclude income from the discharge of debt on their principal residence. Debt reduced through mortgage restructuring, as well as mortgage debt forgiven in connection with a foreclosure, qualifies for the relief. Be cautioned that the issue is more complex than that, and you should discuss it with a tax advisor.

What if the homeowners have more than one mortgage? Multiple mortgages significantly complicate the short sale process, especially under circumstances where the present value of the home is insufficient to cover the first mortgage (because, under such circumstances, the first lender must be convinced to share some of the net proceeds with the second lender).

Generally, the second lender is offered a small percentage of the outstanding loan amount, typically 6%. That might not seem like much when compared to the second loan balance, however, if the second lender refuses, it may ultimately receive nothing. The second lender must agree to release the second loan. If not, the short sale will be denied, and the first lender will most likely get the property back in foreclosure, eliminating the second loan.

What if the homeowners have private mortgage insurance? This is a deadly combination! PMI is insurance that lenders require from most homebuyers who obtain loans that are more than 80 percent of their new home’s value. In other words, buyers with less than a 20 percent down payment are normally required to pay PMI.

PMI does not cover the full exposure of the lender. The PMI insurer is covering the top slice (maybe 20% in this case) plus some fees. In the case of an 80% loan, then PMI is usually 20% of loan amount. In order for the Lender not to void their claim for the PMI coverage, several things must happen. The lender must manage the default to its completion, usually foreclosure or a workout or short sale. Any agreement short of foreclosure must be approved by the PMI company.

The PMI insurer may want the house back following a foreclosure, in order to attempt to recoup any loss that it has suffered due to a claim. In that instance, the PMI insurer may not approve a short sale. The PMI insurer will often approve a short sale if the market indicates that it may have no shot at recouping its loss or claim. Or often, there is some middle ground, whereby the Lender could sell it for 85 to 90% of the original loan amount, thereby reducing any such claim to PMI. Much like any foreclosure and dealing with Loss Mitigation, each case is unique and complex.

Just know that unless you are paying 100% of what is owed the lender, it will need to get the PMI insurer to concur with any decision, so that the lender does not void its opportunity to file an insurance claim.

The lender will be able to collect the insured amount from the PMI insurance company in the event of a foreclosure. Therefore the lender has very little incentive to negotiate a short sale where the purchase price is less than the potential PMI insurance payment.

What if the property is an investment and not the primary residence? The actual short sale process is identical to that of a primary residence, however, for the investor, there is virtually no chance of a deficiency waiver from the lender. Therefore, the investor will be required to bring cash to close, sign a promissory and/or have to pay the IRS when a 1099-C is issued (remember that the Mortgage Debt Relief Act applies only to primary residential property).

Will the homeowner qualify for HAFA? For the single family residential homeowner there is a Federal Government initiative called Home Affordable Foreclosure Alternatives (“HAFA”) which may provide the seller with protection from a deficiency judgment and sometimes allows for the seller to receive as much as $3000.00 cash proceeds at closing for relocation assistance.

The borrower may be eligible for HAFA if all of the following requirements have been met:

- Owner occupied or job relocation further than 100 miles from the Property;

- Mortgage before Jan 1, 2009;

- Mortgage less than $729,000;

- Monthly mortgage payment exceeds 31% of monthly gross income;

- Borrower has applied for HAMP (Home Affordable Modification Program) or has been denied HAMP Modification; and

- Borrower has not filed for Bankruptcy.

Any first lien loan originated before January 1, 2009 and secured by a borrower’s principal residence may be eligible — even a loan currently in foreclosure or (at the servicer’s discretion) involved in bankruptcy proceedings, EXCEPT:

- Loans previously modified under the Home Affordable Modification Program;

- Loans secured by condemned properties; and

- Loans subject to full lender recourse.

The program has been extended to Dec. 31, 2013. The HAFA short sale or deed in lieu of foreclosure can be initiated up to Dec. 31, 2013; however, the transaction must have a closing date on or before Sept. 30, 2014. It is important to note that although the HAFA program is a Federal initiative, it is NOT a law. May lenders and investors choose not to participate in the HAFA program. Freddie MAC and Fannie Mae participation in HAFA ended on December 31, 2012.

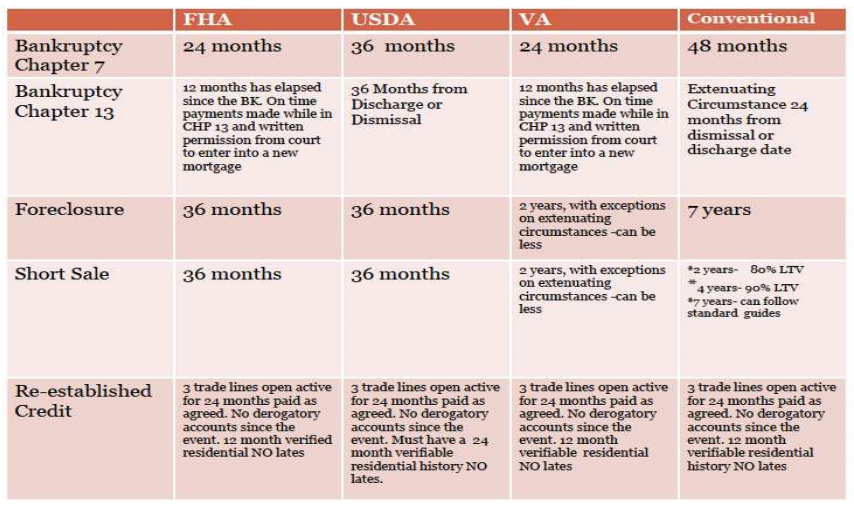

See below for general guidelines on credit repair and mortgage qualifications.

Information provided by:

11930 Fairway Lakes Drive, Suite 2, Fort Myers, Florida 33913

Phone: 239-768-0144 Fax: 239-768-2833

www.ericborgialaw.com